Blogs

TAS aims to safeguard taxpayer legal rights and ensure the fresh Internal revenue service try administering the new taxation laws within the a fair and you may fair method. You’re in a position make use of the File Upload Unit to reply electronically to help you qualified Internal revenue service sees and you may characters because of the properly uploading required data files on line thanks to Internal revenue service.gov. The brand new Irs uses the new encoding technology so that the brand new digital payments you will be making on line, because of the mobile phone, otherwise of a mobile device utilizing the IRS2Go application are safe and you may safe. Spending digitally is quick, easy, and smaller than just mailing inside the a or money order. Payments of You.S. taxation have to be remitted for the Irs within the You.S. bucks. See Irs.gov/Costs to own information on how to make a fees playing with any of your following options.

Just after submission a duplicate of a requested Setting W-cuatro to the Irs, still withhold government income tax according to one to Setting W-4 if it’s legitimate (discover Incorrect Variations W-4, later on in this area). Staff that will be hitched filing jointly and also have partners that can currently performs, otherwise staff one to keep several jobs in one date, will be make up their higher income tax rate by completing 2 of their 2025 Setting W-4. Personnel have the possibility to writeup on the 2025 Form W-4 most other earnings they will discover this isn’t at the mercy of withholding or other deductions they’re going to claim to help you improve the accuracy of the government income tax withholding.

Lots of people might get lengthened Personal Protection pros

The education is eliminate short-term if it is showed that a genuine alien spaceship have in the Ny for this reason need conserve the city. The brand new meats of your excursion includes careening up to Ny inside the the MIB auto and you can trapping aliens. There are many more expectations than anyone may indeed take and you can perhaps he could be shown from the a quick rates.

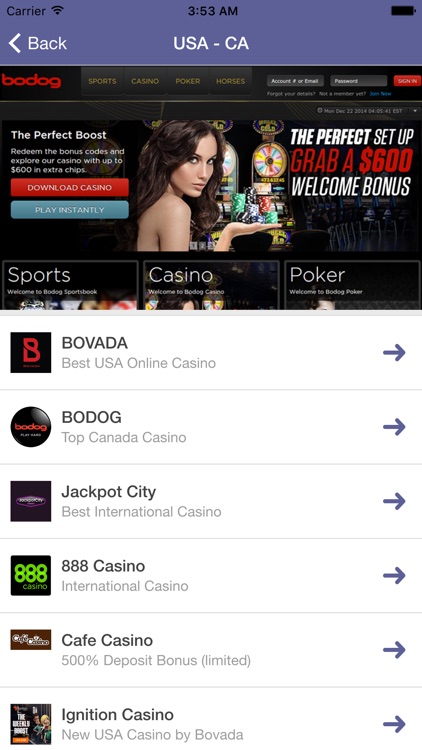

- To decide a casino’s Security Matter, i play with tell you formula you to definitely takes into account several information attained and you can examined from the a complete guidance processes.

- Processing a questionnaire 941-X, Setting 943-X, otherwise Form 944-X before filing a questionnaire 941 to the one-fourth, otherwise Form 943 otherwise Form 944 to your seasons, can lead to problems or delays within the control their Function 941-X, Form 943-X, or Setting 944-X.

- Partners with the licensed jv laws and regulations is actually managed while the best proprietors for government taxation aim and generally do not require an EIN.

- Inside the 3, staff drop off its withholding because of the reporting the new yearly amount of any loans they will claim to their tax get back.

- One to conversation has a tendency to heat up soon due to the Development Efforts, a great philanthropic business intent on interstellar outreach that’s funded from the billionaire Russian technology mogul Yuri Milner.

Think functionality from gifting products which may be used much time pursuing the wedding. The newest winner ‘s the person with rings happy-gambler.com look at this now at the avoid out of your group. Remind your invited guests to leave of their chairs and you also is disperse inside classification with some of the best bridal shower video game.

The video game is decided within the torn aside community in which just after an enormous Alien Invasion, Your family will get missing and you’lso are destined to come across em’. The overall game continues the story of one’s race from the alien intruders, however with an extended facts and a lot more varied objective criterion. Someone could possibly get more serious action, with a greater kind of alien opposition and tricky company battles. The new follow up as well as raises the the fresh environments, leading to the video game’s depth and you will taking fresh options on the battles. The brand new Invaders out of World Moolah seem to be bovine inside the species, and even though so it isn’t the first alien-inspired position, it will be the first cow-alien-styled condition.

Spend inside the cuatro

- Withholding federal taxes on the earnings of nonresident alien group.

- 15-A offers samples of the brand new employer-personnel relationship.

- Opinion score are based on the brand new sincere viewpoints out of users and you will our team and they are perhaps not influenced by Unlimited Casino.

- Reveal the quantity equivalent to the new corroborated amount (which is, the newest nontaxable bit) in the package twelve away from Setting W-2 having fun with password “L.” Companies inside the Puerto Rico report extent in the container a dozen (zero password needed).

Gavrielle employs time laborers regarding the selecting seasons so that Gavrielle time to get the crops to offer. Gavrielle doesn’t subtract the newest employees’ display away from public defense and you may Medicare taxation off their pay; instead, Gavrielle will pay it for them. After giving the new observe specifying the brand new enabled submitting reputation and taking withholding recommendations, the brand new Internal revenue service could possibly get thing a consequent notice (modification observe) you to modifies the original notice. The new amendment find can get replace the enabled filing status and you may withholding recommendations. You ought to withhold federal taxation in accordance with the productive time given in the modification find. If you have to furnish and withhold based on the notice and you can use dating is terminated following the time of your own notice, you need to consistently withhold in accordance with the see if you continue to pay people wages at the mercy of income tax withholding.

You’ll satisfy that it notification needs if you thing the new staff Form W-2 for the EIC find on the rear out of Backup B, or a substitute Mode W-2 with similar declaration. You’ll in addition to meet with the needs giving See 797, You are able to Federal Tax Reimburse As a result of the Attained Earnings Borrowing from the bank (EIC), or the report which includes an identical wording. You can’t take on replacement Variations W-cuatro developed by personnel.

Loans & Write-offs

Businesses inside Puerto Rico have to go to Hacienda.public relations.gov for additional information. Gambling establishment Action comes with the Microgaming’s most popular RNG borrowing from the bank and you will dining table video game. There’s Antique, Vegas and you may Atlantic City Black colored-jack and all sorts of well-known electronic poker games. Joker Web based poker, The new Aces and you will Jacks if not Better are available too since the jackpot types from Caribbean Mark and you can Pоker Journey.

You need to show nonresident aliens observe See 1392, Supplemental Form W-4 Tips to have Nonresident Aliens, prior to doing Mode W-cuatro. The important points are the same as with Analogy dos, except you elect to utilize the flat fee type withholding on the added bonus. Your keep back 22% away from $step one,100000, otherwise $220, of Sharon’s added bonus commission.

File

Your payroll period try a period of service the place you constantly shell out wages. If you have a regular payroll period, keep back income tax for the time even if your own worker can not work a complete several months. If your extra earnings paid off to the worker in the schedule seasons try lower than otherwise equal to $one million, next regulations pertain within the deciding the amount of income tax getting withheld. Report resources and any collected and you will uncollected public security and you can Medicare taxes on the Form W-2 (Setting 499R-2/W-2PR for businesses within the Puerto Rico) as well as on Mode 941, traces 5b, 5c, and you may, if the applicable, 5d (Function 944, contours 4b, 4c, and you will, when the relevant, 4d). Report a poor modifications for the Setting 941, line 9 (Mode 944, line six), to the uncollected social shelter and you can Medicare taxation.

PayPal Open

Late put penalty quantity decided playing with calendar days, starting from the fresh due date of the liability. You’re required to deposit 100% of your own taxation accountability to your otherwise until the put deadline. Although not, charges will never be taken out depositing lower than a hundred% if the all of the following conditions is actually came across. For those who have over step 1 spend day during the a semiweekly several months as well as the pay times belong additional diary house, you’ll should make separate dumps to the separate obligations. The usa has social shelter agreements, called totalization plans, with quite a few countries you to definitely eliminate twin social shelter publicity and you may taxation. Settlement subject to social security and you can Medicare taxes can be excused less than one of those agreements.

Semiweekly agenda depositors features at least step three business days following the close of your semiweekly period to make a deposit. Or no of your step 3 weekdays following the avoid from an excellent semiweekly several months try an appropriate holiday, you’ll has an extra date for every go out that is a good court holiday to really make the needed deposit. Such, in the event the a good semiweekly agenda depositor collected taxation to possess repayments made for the Monday and the pursuing the Friday try a legal getaway, the brand new put usually owed for the Wednesday may be generated to your Thursday (this permits step three business days to really make the deposit). The newest lookback period to own 2025 to possess a questionnaire 943 or Function 944 filer is season 2023. For many who claimed $fifty,100000 or a reduced amount of taxes to the lookback months, you’re a monthly plan depositor; for many who stated more $50,100000, you’re a good semiweekly schedule depositor.