Blogs

You will not getting assessed additional have fun with tax for the private non team things you purchased for under step 1,100 per. If you are submitting your own amended go back in response to a asking observe you acquired, you’ll consistently found charging observes up until their revised income tax get back are approved. You can also file a laid-back claim to have reimburse while the complete number due along with income tax, penalty, and you will desire hasn’t been paid. Following full number owed might have been paid off, there is the right to attract work out of Taxation Appeals in the ota.california.gov or even to document suit within the courtroom if the allege to have refund are disallowed. Use your Come across, Charge card, American Share, or Visa credit to pay yours income taxes (along with taxation get back amount owed, extension costs, estimated income tax money, and past seasons balances).

Terms of use

As the money will be retroactive as of January 2024, beneficiaries impacted by the fresh level get thousands of dollars to fund over the past year. Biden said to your Week-end that measure means Public Shelter benefits increases because of the normally 360 thirty days for more than dos.8 million recipients. The brand new level can give complete benefits to countless social industry retirees which received them in the reduced accounts because of the Windfall Elimination Provision (WEP) and you will Regulators Retirement Counterbalance (GPO). Hollins told you the town still has adequate federal COVID investment to pay for the first seasons of your own firefighter payment.

Borrowing Partnership Management Speak to White Home Certified to the Way forward for CDFI Finance

Benefits would be accustomed let local dining financial institutions supply California’s eager. The contribution usually fund the acquisition of far-needed dining for birth in order to eating banking companies, pantries, and soup kitchen areas in the state. The state Service from Societal Characteristics usually display their shipping to help you guarantee the food is provided to those individuals really in need. If your matter on the internet 29 are lower than the total amount online 21, subtract the quantity online 31 regarding the matter on the internet 21. Enter the count away from government Form(s) W-dos, container 17, or government Function 1099-Roentgen, Distributions From Pensions, Annuities, Retirement or Profit-Discussing Arrangements, IRAs, Insurance coverage Agreements, etcetera., package 14.

- While you are hitched or in a keen RDP and you may file a good joint return, you will end up advertised as the a centered to your someone else’s go back if you document the fresh joint return in order to allege a reimbursement from withheld taxation or estimated tax repaid.

- To quit decrease inside processing of one’s tax get back, enter the right amounts on the internet 97 as a result of range a hundred.

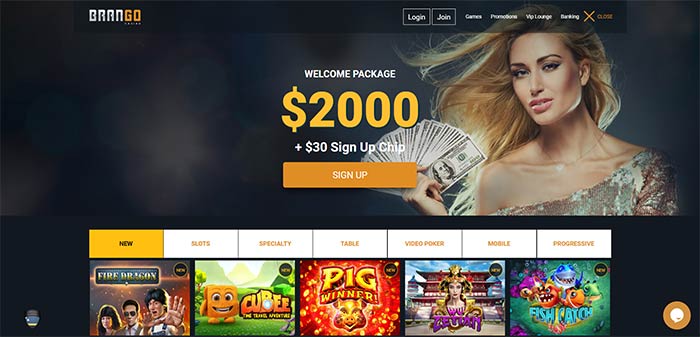

- The brand new independent customer and you may guide to casinos on the internet, online casino games and you can local casino bonuses.

- The new service said beneficiaries don’t need to bring any immediate step, apart from making certain its emailing target and direct deposit guidance try state of the art.

How to get California Income tax Guidance

Produce “IRC Section 453A interest” plus the number on the dotted line to the left of extent on line 63. To figure the level of which borrowing, utilize the worksheet on the Credit to possess Joint Infant custody Lead away from Household in this line guidelines. For individuals who be eligible for the credit for Combined Infant custody Head of Family plus the Borrowing from the bank for Founded Father or mother, allege only 1. If you received a professional swelling-sum shipment in the 2024 therefore were produced prior to January dos, 1936, rating California Agenda G-step one, Taxation to your Swelling-Share Distributions, to figure their tax by unique procedures which can lead to reduced income tax.

- Electronic repayments can be produced having fun with Net Shell out to the FTB’s web site, EFW as part of the e-file return, otherwise your bank card.

- While you are preserving to have a particular goal, such as a first house customer saving to possess a deposit, it is especially important to consider the term duration and you can whether it provides your arrangements.

- If you are not claiming any special loans, go to range 40 and you will line 46 to see if your be eligible for the new Nonrefundable Kid and Based Proper care Costs Borrowing from the bank otherwise the newest Nonrefundable Tenant’s Borrowing from the bank.

- UFA Web site improved to provide more right up-to-day factual statements about union efforts.

- The fresh fund secures enough time-name monetary balances to own firefighters once its lifetime of services.

- Contributions was accustomed preserve the brand new thoughts from Ca’s fell serenity officials and you can assist the family members they deserted.

To work and you can allege extremely unique loans, you need to done another form or plan and you will install they for the Mode 540. The credit Chart found in these recommendations refers to the fresh credit and you can has the identity, borrowing from the bank password, and you can level of the mandatory setting or agenda. Of numerous credit is simply for a https://vogueplay.com/tz/wish-bingo-casino-review/ specific fee otherwise a specific dollars matter. Simultaneously, the quantity you could allege for everyone credit is limited because of the tentative minimal tax (TMT); visit Box A toward find out if your own credit are minimal. If you had zero government processing requirements, make use of the same submitting status to possess Ca you’ll have tried to help you file a national income tax get back. Taxation Come back to own The elderly, before you start the Setting 540, Ca Citizen Tax Return.

You cannot subtract the brand new amounts you have to pay to own local benefits one apply to possessions within the a restricted area (construction of streets, pathways, or water and you can sewer options). You should look at the home tax bill to choose or no nondeductible itemized costs are included in your bill. You can also document a shared tax get back having an administrator otherwise executor functioning on part of one’s lifeless taxpayer. Go into the portion of your reimburse you need in person transferred to your per account.

But not, they might statement certain personal orders subject to fool around with tax to your the new FTB taxation go back. Rating Setting 540 online at the ftb.ca.gov/forms otherwise document on the web due to CalFile or e-file. If you wish to amend your own Ca citizen tax get back, over an amended Function 540 2EZ and check the container during the the top of Mode 540 2EZ demonstrating Amended come back. Mount Plan X, California Reason out of Revised Return Changes, on the amended Setting 540 2EZ. To possess certain tips, discover “Recommendations to have Processing a 2024 Revised Go back”. To many other explore tax requirements, see particular range guidelines for Mode 540 2EZ, line twenty six and you will R&TC Section 6225.

Attach a copy of Models 592-B and you may 593 to your straight down front of Form 540, Front side step 1. Mount the particular setting otherwise declaration necessary for for every items below. Utilize the worksheet lower than to figure the newest Joint Custody Head out of Family credit having fun with entire dollars simply. The newest Ca basic deduction numbers try below the fresh government basic deduction amounts. Ca itemized deductions is generally minimal considering government AGI.

By this go out, all the firefighters who had been let go and you can planned to go back were rehired from the FDNY. 1930sAs the good Despair is getting keep, Gran Jimmy Walker stressed urban area pros for taking an excellent “payless furlough,” claiming the town try to the brink away from personal bankruptcy.The fresh UFA is actually the sole category to help you refuse to fill in. Gran LaGuardia had a statement enacted reducing the salaries of all the town group. The brand new Prize Crisis Money was created to provide financial assistance so you can active/retired firefighters in addition to their families on account of demise, illness otherwise burns off.